does indiana have estate or inheritance tax

The final income tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

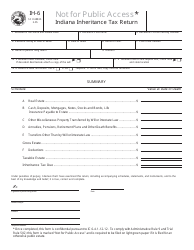

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Inheritance tax was repealed for individuals dying after December 31 2012.

. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. Indiana is one of 38 states in the united states that does not have an estate tax.

Here in Indiana we did have an inheritance. 1 day agoThe new king will avoid inheritance tax on the estate worth more than 750 million due to a rule introduced by the UK government in 1993 to guard against the royal familys. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

No Estate Tax Or Inheritance Tax. 19 hours agoA rule introduced by the UK government in 1993 said inheritance tax does not have to be paid on the transfer of assets from one sovereign to another. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate.

The top estate tax rate is 16 percent exemption threshold. For those who do not plan the amount of Federal Estate Tax that will be required to be paid can. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for.

Indiana repealed the inheritance tax in 2013. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012. These taxes may include.

At this point there are only six states that impose state-level inheritance taxes. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

On the federal level there is no inheritance tax. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate. The Inheritance tax was repealed.

How Much Tax Will You Pay in Indiana On 60000. Here in Indiana we did have an inheritance. In 2022 federal estate.

No inheritance tax has to be paid for individuals dying after December 31 2012. The amount can be doubled for a married couple with properly drafted Wills or Trusts. How much money can you inherit without paying inheritance tax.

Indiana residents do not need to worry about a state estate or inheritance taxIndiana does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. 1 day agoIn the wake of Queen Elizabeth IIs death last Thursday King Charles III inherited a realm of wealth and he doesnt have to pay inheritance tax on any of it. A federal estate tax is in effect as of 2021 but the exemption is.

Even though Indiana does not collect an inheritance tax. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds.

States Without Death Taxes. Although some Indiana residents will have to pay. If you have received an inheritance or know you will be receiving one and live in one of the states that impose the state.

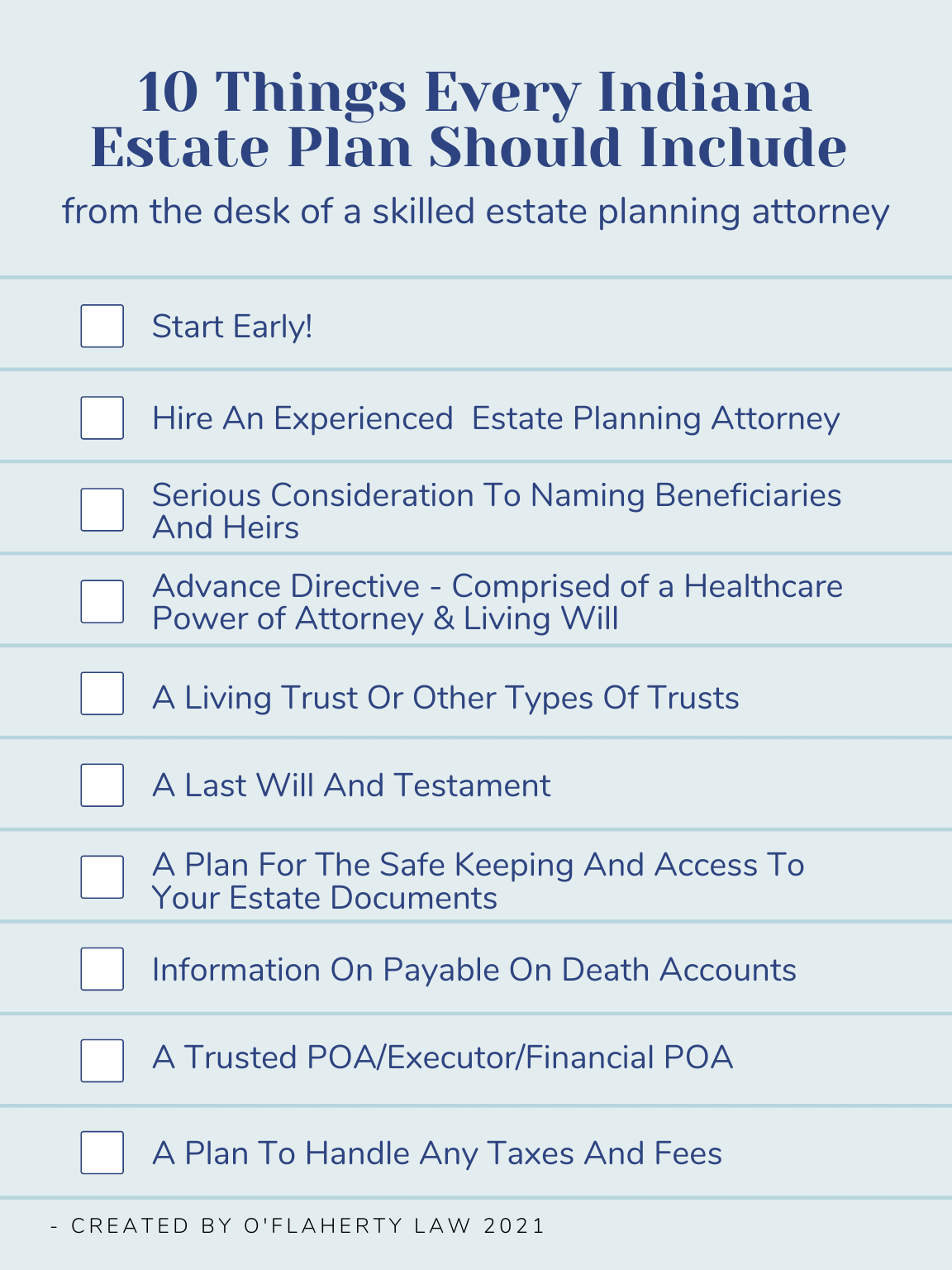

10 Things Every Indiana Estate Plan Should Include

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Here S Which States Collect Zero Estate Or Inheritance Taxes

Where Not To Die In 2022 The Greediest Death Tax States

Where Not To Die In 2022 The Greediest Death Tax States

Where Not To Die In 2022 The Greediest Death Tax States

10 Things Every Indiana Estate Plan Should Include

Historical Indiana Tax Policy Information Ballotpedia

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Where Not To Die In 2022 The Greediest Death Tax States

10 Things Every Indiana Estate Plan Should Include

Where Not To Die In 2022 The Greediest Death Tax States

Where Not To Die In 2022 The Greediest Death Tax States

Form Ih 6 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return Indiana Templateroller

Create A Living Trust In Indiana Legalzoom

Where Not To Die In 2022 The Greediest Death Tax States

Using A Living Trust To Avoid Leaving A Lump Sum Inheritance Indianapolis Estate Planning Attorneys